Ok, I for one am feeling somewhat positive about this budget, both for individuals and for small business. Of course, these ‘promises’ have to be passed and approved … but at least they are on the drawing board and unfortunately many of the ‘benefits’ are not going to occur for some time … so it becomes somewhat of a waiting game to realise those positives.

Ok, I for one am feeling somewhat positive about this budget, both for individuals and for small business. Of course, these ‘promises’ have to be passed and approved … but at least they are on the drawing board and unfortunately many of the ‘benefits’ are not going to occur for some time … so it becomes somewhat of a waiting game to realise those positives.

Here is a succinct summary of what has been advised for the budget:

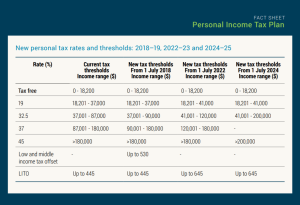

1. Individual Tax Rates to Drop

If you look at the scale below (courtesy Xero.com.au) then you’ll see that tax rates are going to drop. But don’t go spending up big … we won’t see the cuts and effects for some time yet (up to seven years) and not everyone will benefit.

2. Company Tax Rates to Drop

Also, we are going to see a slight dip in corporate tax rates, moving from 27.5% to 25% … but it won’t be until around 2026-27 … so another one you’ll have to hold your breath and wait for. That’s if your turnover is under $50M. Those with a turnover of greater than $50 million are lobbying for relief … we may have to wait and see what happens in the larger corporate arena.

3. Instant Asset Write-offs of $20K or less continue another year

The immediate deduction of asset purchases (under $20K) will continue for the time being; meaning you don’t have to depreciate an asset (up to $20K) over several years. Good news in my view. Also, the threshold level of ‘small business’ will increase from $2M to $10M.

4. Training, Education & Employment

There are plans for more young apprentices and retraining for older workers … plus more support for new start-up business and small business. Tax concessions, support and R&D incentives are being promised also. $250M has been allocated to upskilling Australians with assistance for 45-70 year olds to transition to other roles.

5. Making it easier to do business with the Government

The Government is promising greater transparency re supplier payments and ensuring small business is paid more promptly on Government contracts. The other pet hate of mine is that small business (well all business) is an unpaid Government agent – we collect tax from wages, we collect GST from customers, we collect super, we manage paid parental leave. Of course, this means the Government gets to pass the buck to business (especially small business) to manage all these aspects at our own admin cost – being an unpaid tax collector for the Government. They have said they will make the BAS system easier, but I’ve heard that for many years … dropping a couple of labels on a BAS form doesn’t quite help us … but hey, let’s stay tuned. Naturally ‘sham contracting’ is on the hit list again … but then, if it wasn’t so hard to employ maybe so many businesses wouldn’t be trying to find shortcuts. Not endorsing … just saying …

6. Superannuation – General

From 1.7.19 those people under the age of 25 will need to ‘opt-in’ to life insurance. This also applies to those with inactive accounts or those with a balance of less than $6K. If you are younger and especially in a dangerous industry, I’d strongly recommend you think seriously about whether life insurance is a smart choice. Also from this date, exit fees will be banned. Admin and investment fees will be capped at 3% for balance accounts with less than $6K. The ATO said they’ll work hard to ‘reunite’ lost funds with their owners and all inactive super accounts with balance under $6K will transfer to the ATO. Fund trustees must create a retirement income strategy for members.

7. Self-Managed Super Funds

The number of members has now been increased from 4 to 6 … which I personally feel is long overdue. Also, auditing of SMSF’s is being moved from annual to three yearly. This is just for the funds that have been ‘good’ and done all the right things. Some say the annual review keeps things in line and sorts out any problems in a timely manner. So whilst reducing the cost will be good, I do hope Trustees stay ‘good’. The guess if they don’t – then there are consequences.

8. Cash, the Black Market & Other Nasties

The Government is going to be spending more on cracking down on the black economy including outlawing cash transfers which are over $10K (effective 1.7.19). This includes fraudulent invoicing, sham contracting and tax avoidance. One thing they are saying is that businesses will no longer be able to claim a tax deduction if they haven’t withheld PAYG … so now more than ever, you need to get this done right and whether you agree with the policy or not – do what needs to be done to be legal. Illegal phoenixing and Directors backdating resignations will be targeted. Illegal Tobacco is being targeted also; a new task force is being created purely for this. $3.6M (over 4 years) is going towards an anti-slavery unit to help mitigate modern-day slavery. The ATO will also get more money for debt collection of both tax and super. I say it frequently, it’s not a matter of IF you will get caught, but WHEN. I strongly recommend ‘playing by the rules’.

9. Other/Miscellaneous

Money is being spent on some areas of infrastructure (airports etc) subject to that state co-contributing. Money will be allocated to public holidays, pharmaceuticals, research and $550M on housing for indigenous residents in the NT. $2.9M is being allocated towards drone safety. Aussie grown craft beer producers will benefit from a lower excise rate on the smaller sized kegs, not just on the larger sized 48L kegs. Tariffs on customers for imported placebos and clinical trial kits are being removed this July. A whopping $48.7M (did so much need to get allocated?!) is going to the commemoration of the 250th anniversary of James Cook’s first voyage. Gosh, I do hope this generates some benefit or income! The polly’s who cover large electorates also gave themselves something extra – up to $20K a year extra each to claim leasing and operation costs. This is expected to cost us $2.2M (over 5 years). A positive – more money is being invested into urban congestion – let’s hope they get it right – $1M for the fund and $3.5M for ‘roads of strategic’ value. An increase in funding will occur for doctors and nurses in regional areas – not population centres. BAS agents and Accountants will face Tax Practitioner Board increases … which unless you’re in this category think ‘so what?’ However, when anything goes up that cost is usually passed onto the end user – so indirectly, this affects pretty much all.

All the above dollar values are Australian dollars.

This is my personal take on the budget and what I’ve seen and read – as always, consult your tax or financial advisor or qualified accountant for tax advice around any issues which are concerning you. Pre 30 June (May … not two days before 30 June) is a great time to meet with your professional advisor and do some tax planning and a general review.

This time of year is also an excellent time to put in place (or review) your business budget. In fact, having a personal budget helps significantly as you know how much profit (or net wage distribution) you need to live on. If the business profit isn’t meeting your personal needs, then it’s time to look at what you’re doing. Either you cut back or you grow your profit. Like to know how? Talk to me about business coaching. I offer 30 minute free consults (subject to availability) for anyone interested in business coaching and mentoring. My coaching services include guidance, support and advice around:

- Finances, money and almost every aspect of money

- Sales, marketing, customer service including perception

- Staff, systems, processes and efficiencies

- Strategy, planning, mindset and leadership mentoring

- And so much more … all borne of 30+ years’ experience helping Aussie businesses.

Call me directly on 0411 622 666 or email donna@donna-stone.com.au. Don’t leave success to luck – make your own victory a reality!